January 2021

2

New Year Picks – January 2021

New Year Special

A Promising start to a new year

India’s economic recovery from the Covid lows has been quicker than expected

and has come as a pleasant surprise for the markets. While India’s recovery from

the pandemic lows was slow to begin, we have witnessed a strong acceleration in

economic activities over the past few months due to reopening of the economy and

festive demand. News flow on the vaccine front continues to be positive as various

countries like the US and UK have started their vaccination program which gives us

hope that the Covid situation should improve significantly by the second half of

2021. Continued monetary and fiscal stimulus by central banks and Governments

has led to a global risk-on environment despite sharp increase in Covid-19 cases

globally. Given the positive sentiments we see continued momentum in cyclical

sectors like auto, banking and consumer durables. We also expect that sectors with

strong revenue visibility like chemicals, IT and pharmaceuticals will also continue

to do well.

India’s economic recovery has been quicker than expected

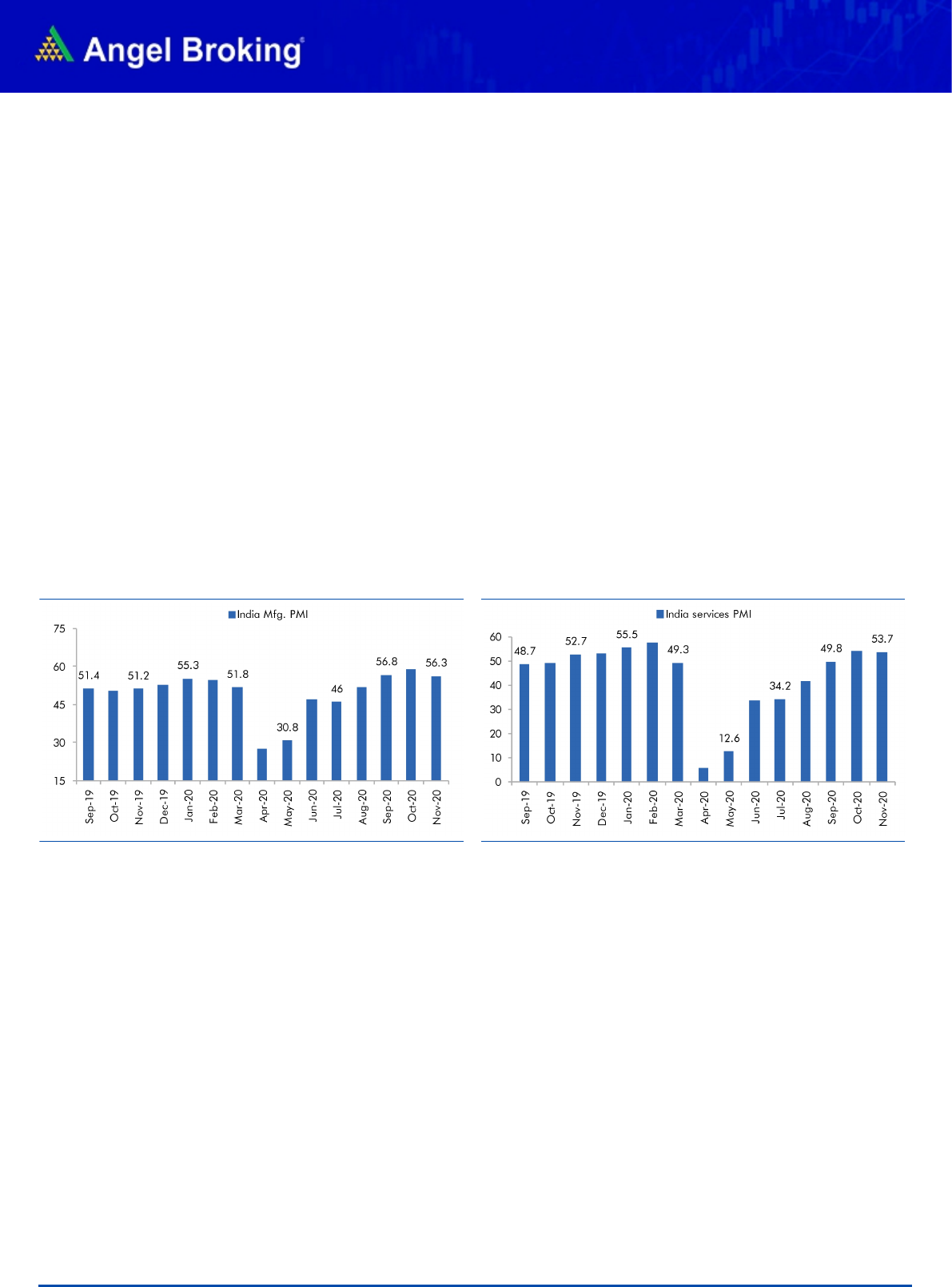

High frequency indicators like PMI numbers, power demand etc. continues to point

to a quicker than expected recovery in the economy. The manufacturing PMI for

November at 56.3 points to continued strong rebound in manufacturing. Though

this is lower than October’s print of 58.9, last three month’s PMI numbers point to

a strong acceleration in the manufacturing sector. Services PMI at 53.7 for the

month of November also points to a solid pace of expansion despite falling from

54.1 in October.

Government stimulus and RBI’s easy monetary policy to support recovery

The Government has announced various rounds of stimulus measures including

the most recent `2.65 lakh Cr. Atmanirbhar Bharat 3.0. The RBI in its latest MPC

meeting has guided that they will maintain their accommodative stance well into

FY2022 despite high inflation. The various fiscal and monetary measures

announced by the Government and the RBI will support the economic recovery.

Vaccination and US stimulus package leading to risk-on environment globally

After months of delay the US Government has successfully passed the second US

stimulus package of USD 900bn which is a positive development for the markets.

Moreover various countries like the US and UK have started their vaccination

program which gives us hope that the Covid situation should improve significantly

by the second half of 2021. Positive developments on the vaccine front along with

continued fiscal and monetary support from Governments and central banks is

leading to a risk on rally despite a surge in Covid-19 cases globally.

We expect the broad based rally to continue for now

The rally in the past few months has become broader with more sectors

participating in the rally. We expect the rally in cyclical sectors will continue for now

given the risk-on environment globally and expect sectors like auto, BFSI,

consumer durables and cement will continue to outperform. While we expect

cyclical sectors will continue to do well we also continue to remain positive on

chemicals, IT and Pharma given strong revenue visibility in these sectors.

Top Picks

Company

CMP (`)

TP (`)

Auto

Swaraj Engines

1,416

1,891

NRB Bearings

102

118

Banking/NBFC

Bandhan Bank

413

525

IDFC First Bank

37

44

Chemicals

Atul Ltd

6,386

7,339

Galaxy Surfactants

2,000

2,284

IT

Persistent Systems

1,490

1,677

Pharma & Healthcare

Metropolis Healthcare

1,949

2,593

Narayana Hrudayalaya

441

500

Others

Gujarat Gas

380

450

Hawkins cooker

5,866

6,776

JK Lakshmi Cement

333

422

Whirlpool India

2,509

3,032

Source: Company, Angel Research

Note: Closing price as on December 29, 2020

January 2021

3

New Year Picks – January 2021

New Year Special

India’s economic recovery has been quicker than expected

India’s pace of economic recovery has been quicker than expected and has

pleasantly surprised the markets. While India’s recovery from the pandemic lows

was slow to begin, we have witnessed a strong acceleration in economic activities

over the past few months due to reopening of the economy and festive demand.

While the economy continued to improve gradually till August there was a

significant acceleration in recovery from September onwards due to unlocking of

the economy and strong festive demand. Moreover the various stimulus packages

provided by the Government is also helping the ongoing recovery process. The

November PMI numbers point to continued acceleration in economic activities

across manufacturing and services.

The manufacturing PMI for November at 56.3 points to continued strong rebound

in manufacturing. Though this is lower than the reading of 58.9 in October, the

last three month PMI numbers point to a very strong acceleration in the

manufacturing sector. Services PMI at 53.7 for the month of November also points

to a solid pace of expansion despite falling from 54.1 in October.

Exhibit 1: Manufacturing has led the economic recovery

Source: Company, Angel Research, Bloomberg, IHS Markit

Exhibit 2: Services sector gathering momentum

Source: Company, Angel Research, Bloomberg, IHS Markit

While the manufacturing sector has led the rebound in growth so far the services

sector which accounts for ~60% of the economy is still lagging. However with

significant portion of the economy being opened up under unlock 4.0 and 5.0 we

are witnessing a rebound in the service sector. The Services PMI has now been

above the 50 mark for two months in a row and points to green shoot of recovery

in the services sector.

While manufacturing has led the first leg of the economic recovery we expect the

services sector will lead the second stage of the recovery. We expect continued

improvement in the services sector as demand is coming back for even the worst

impacted sub sectors like travel, tourism and hospitality.

We expect the services sector will lead

the next leg of the economic rebound

High frequency data point to quicker

than expected recovery in economy.

Services PMI reading above 50 for two

months in a row now

January 2021

4

New Year Picks – January 2021

New Year Special

RBI’s accommodative stance to help transmission of rate cuts

The Reserve bank of India (RBI) in its bimonthly MPC meeting maintained status

quo with the benchmark repo and reverse repo rates being left unchanged at 4.0%

and 3.35% respectively. This was in line with market expectations which had

expected to RBI to maintain rates despite high inflation level of 6.7%. Though

inflation is likely to remain at the higher end of the RBI’s target range of 2-6% in

the foreseeable future the RBI continued with its accommodative stance and has

indicated that they are willing to look through higher inflation numbers.

Exhibit 3: Rate cut of 250bps by RBI in current cycle

Source: RBI, Angel Research, Bloomberg

Exhibit 4: However full transmission yet to happen

Source: RBI, Angel Research, Bloomberg

While the RBI has cut the repo rate by 250bps since the beginning of the current

easing cycle in early 2019, lack of transmission has so far prevented the full

benefits from flowing into the hands of the borrowers. This is reflected in very high

spreads between the repo rate and the G-Sec rate which is hovering between 180-

200bps. This is largely due to elevated inflation and high levels of government

borrowings expected this year. However we expect spreads between the overnight

rate and the G-Sec rates normalize gradually through FY2022 due to pick up in

Government revenues along with fall in inflation levels to 4.6-5.2% by the first half

of FY2022 from peak of 7.6% in October 2020.

Exhibit 5: RBI expects Inflation rates to cool off going forward

Source: RBI, Angel Research, Bloomberg

RBI to maintain accommodative stance

well into FY2022.

January 2021

5

New Year Picks – January 2021

New Year Special

Government Stimulus packages to also help recovery

The Government and the RBI have also announced stimulus packages of `30lakh

Cr. so

far

. While the RBI has announced monetary measures of

`

12.7lakh Cr. so

far the Government too has announced fiscal measure of `17.2lakh Cr. so far.

The government had announced a fiscal package of `11.0lakh Cr. under

Atmanirbhar Bharat 1.0 in the month of May’20 post which it has announced

various other fiscal packages culminating with the most recent `2.65 lakh Cr.

Atmanirbhar Bharat 3.0.

Providing support to the rural economy and SME’s had been the key focus area for

the Government in all the stimulus packages announced so far by the Government.

However in the last stimulus package there was a clear focus on boosting domestic

manufacturing along with providing support to the real estate sector. The measures

announced so o far by the Government should help support the current economic

recovery given its focus on critical sectors like agriculture, manufacturing and real

estate which are key employment generators.

Exhibit 6: Atmanirbhar Bharat 3.0 package (` cr.)

List of major announcement under Atmanirbhar Bharat 3.0 (INR Cr.)

Boost for Atmnanirbhar Manufacturing (PLI)

1,45,980

Support for Agriculture – Fertiliser Subsidy

65,000

Housing for All - PMAY-U

18,000

Industrial Infrastructure and Domestic Defence Equipment

10,200

Boost for Rural Employment

10,000

Boost for Infrastructure – equity infusion in NIIF Debt PF

6,000

Atmanirbhar Bharat Rozgar Yojana (overall Rs 36,000 cr)

6,000

Boost for Project Exports – Support for EXIM Bank

3,000

Total

2,65,080

Source: GOI, Angel Research

Exhibit 7: Total stimulus so far (` cr.)

Total Stimulus so far (NR Cr.)

Fiscal package announced by the Government

Pradhan Mantri Garib Kalyan Package (PMGKP) +

1,92,800

Atmanirbhar Bharat Abhiyaan 1.0

11,02,650

PMGKP Anna Yojana – extension of 5 months from Jul - Nov

82,911

Atmanirbhar Bharat Abhiyaan 2.0 (12th October)

73,000

Atmanirbhar Bharat Abhiyaan 3.0

2,65,080

Fiscal Measures announced by RBI so far

RBI measures announced till 31st Oct 2020

12,71,200

Total

29,87,641

Source: GOI, Angel Research

The stimulus packages have been in line with the Governments strategy of

providing targeted support to the most critical sectors given the lack of fiscal space

to provide direct stimulus to the economy in the form of large cash spending.

However we believe that more needs to be done in the form of direct spending by

the Government and expect that the Government will step up its direct spending in

the next few months of FY2021.

Government stimulus packages have

been focused on key employment

generating sectors.

We expect increase in direct

Government spending going forward.

January 2021

6

New Year Picks – January 2021

New Year Special

Positive global sentiments will lead to continued strong FII flows

After months of delay the US Government’s has successfully passed a USD 900bn

second stimulus package. This is a positive development for the markets especially

in the backdrop of a surge in Covid-19 cases in Europe and the US. The surge in

Covid-19 cases has led to many countries implementing restrictions and social

distancing guidelines which are expected to lead to a pullback in global economic

activity in the fourth quarter of 2020.

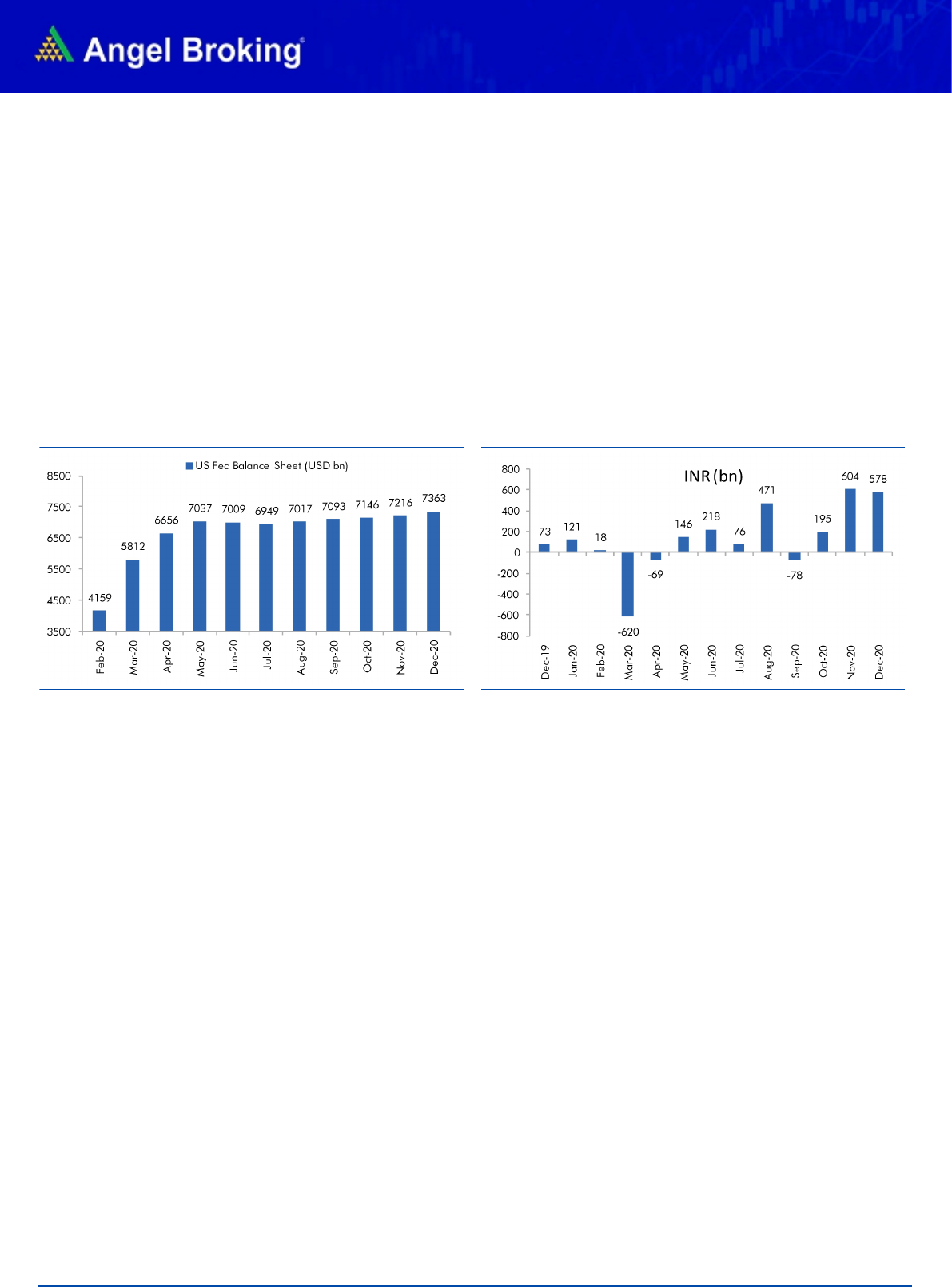

The US Fed too has stepped up its quantitative easing program post the US

elections. This will lead to continued surge in global liquidity which will result in

continued FII flows into emerging markets including India.

Exhibit 8: US Fed stimulus driving global flows

Source: Company, Angel Research, Bloomberg

Exhibit 9: India has attracted record FII flows in FY21

Source: Company, Angel Research, Bloomberg

Market view and outlook

We believe that opening up of the economy along various stimulus measures

announced by the Government and the RBI should lead to continued improvement

in the economy. Global sentiments are expected to remain buoyant given that

development on the vaccine front has been better than market expectations.

Moreover continued fiscal and monetary support from Governments and central

banks will also provide support to the markets despite a surge in Covid-19 cases

globally.

The rally in the past few months has become broader with more sectors

participating in the rally. We expect that the rally in cyclical and beaten down

sectors will continue for now given the risk on environment globally. We believe

that auto, BFSI, consumer durables and cement should continue to do well. We

also expect the rural, essential and digital theme to continue playing out over the

next few quarters given revenue visibility and strong growth prospects. We

therefore continue to maintain our positive outlook on sectors like chemical, IT,

and Pharmaceuticals.

We expect broad based rally to

continue for now.

Second US stimulus package is a

positive development for markets.

January 2021

7

New Year Picks – January 2021

New Year Special

Exhibit 10: Rationale – Angel Top Picks

Company

CMP (`)

TP (`)

Rationale

Auto

Swaraj Engines

1416

1,891

Strong recovery in the tractor industry (due to robust Rabi crop, hike in MSP & a normal

monsoon) will benefit players like Swaraj Engines.

NRB Bearings

102

118

We expect company to post strong recovery in topline led by rebound in demand in domestic

auto sector. Exports to also register strong growth led by existing as well as new customers.

BFSI

Bandhan Bank

413

525

Strong deposit base & low cost of funds coupled with diversification away from West Bangal and

MFI along with stable NIM's and RoE's will lead to a retaing for the bank

IDFC First Bank

37

44

We believe efforts to built retail liability franchise, fresh capital infusion and provision taken on

the wholesale book will help to tide over this difficult time.

Chemicals

Atul Ltd

6,386

7,339

Atul has very strong chemistry skill sets and will be one of the biggest beneficiaries due to

shifting of production from China

Galaxy Surfactants

2,000

2,284

We expect strong growth for the company due to exposure to personal and home care segment

and recovery in the specialty segment

IT

Persistent Systems

1,490

1,677

Company has won deals worth USD 150mn in Q1Y21 and management has highlighted

strong deal pipeline which will drive growth in H2FY21.

Pharma & Healthcare

Metropolis Healthcare

1,949

2,593

We are positive on the company given expected long term growth rates of ~15% CAGR,

stable margins profile and moderating competitive intensity.

Narayana Hrudayalaya

441

500

We are positive on the hospital sector with Narayana Hrudayalaya well placed for growth of 10-

15% CAGR. We expect capex to be very limited in the near future and cash flows to improve

significantly.

Others

Gujarat Gas

380

450

Company witnessing strong demand growth from the Industrial sector due to fall in gas prices

and also due to environmental concerns of using petcoke as a feedstock in manufacturing

sector

Hawkins cooker

5,866

6,776

Gaining market share with peer, strong demand post Covid-19 and increase in penetration of

cooking gas to drive higher growth.

JK Lakshmi Cement

333

422

It is trading at a significant discount compared to other north based cement company such as JK

Cement as well as historical valuation.

Whirlpool India

2,509

3,032

Going forward, we expect healthy profitability on the back of a strong brand, wide distribution

network, capacity expansion & strengthening product portfolio.

Source: Company, Angel Research

January 2021

8

New Year Picks – January 2021

New Year Special

Exhibit 11: Top Picks Valuation Table

Market Cap

(` cr)

CMP

(`)

Sales

(`)

PAT

(`)

ROE

(%)

P/E

(x)

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

Auto

Swaraj Engines

1,718

1,416

774

899

66

86

16.2

17.1

25.9

19.9

NRB Bearings

985

102

697

898

33

72

6.8

13.2

29.7

13.8

Chemicals

Atul Ltd

18,943

6,386

3,946

4,981

697

837

17.8

18.0

27.2

22.6

Galaxy Surfactant

7,092

2,000

2,797

3,223

272

324

21.4

21.2

26.0

21.9

IT

Persistent Systems

11,391

1,490

4,077

4,645

408

513

15.2

16.7

27.9

22.2

Pharma & Healthcare

Metropolis Healthcare

9,960

1,949

990

1,163

173

217

26.3

26.4

57.6

45.8

Narayana Hrudayalaya

9,015

441

2,643

3,930

(60)

235

-

18.5

-

38.4

Others

Gujarat Gas

26,179

380

9,428

12,522

1,442

1,517

33

26

18.2

17.3

Hawkins cooker

3,102

5,866

658

750

59

80

32.5

42.4

52.4

39.0

JK Lakshmi cement (Standalone)

3,923

333

4,151

4,505

315

333

14.5

17.0

12.5

11.8

Whirlpool India

31,843

2,509

5,607

6,448

337

485

18.4

26.5

94.5

65.7

Source: Company, Angel Research

Exhibit 12: Top Picks Valuation Table – Banking/NBFC

Particular

Market Cap

(` Cr)

CMP

(`)

NII

(` Cr)

PAT

(` Cr)

EPS

(`)

ROE

(%)

P/BV

(x)

FY21E

FY22E

FY21E

FY22E

FY21E

FY22E

FY21E

FY22E

FY21E

FY22E

Bandhan Bank

66,516

413

13,019

15,179

3425

4725

21.3

29.3

20.8

24.0

3.8

3.1

IDFC First Bank

20,818

37

7,138

9,139

76

1793

0.1

3.2

0.5

8

1.2

1.1

Source: Company, Angel Research

Note: CMP is Closing price as of December 29, 2020

January 2021

9

New Year Picks – January 2021

New Year Special

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information

Ratings (Based on expected returns Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15)

January 2021

10

New Year Picks – January 2021

New Year Special